nevada estate tax rate 2021

Tax Rate 32782 per hundred dollars. NRS 3614723 provides a partial abatement of taxes.

2022 Federal State Payroll Tax Rates For Employers

They usually invoice clients a fraction of any tax reduction instead of set out-of-pocket fee.

. The median property tax in Nevada is 174900 per year for a home worth the median value of 20760000. Nevada has a 685 percent state sales tax rate a max local sales tax rate of 153 percent and an average combined state and local sales tax rate of 823 percent. Counties cities school districts special districts such as fire protection districts etc.

Property Tax Rates for Nevada Local Governments Redbook NRS 3610445 also requires the Department to post the rates of taxes imposed by various taxing entities and the revenues generated by those taxes. 072 of home value Yearly median tax in Clark County The median property tax in Clark County Nevada is 1841 per year for a home worth the median value of 257300. Nevada also has low property tax rates which will usually be half of 1 to 1 of assessed value.

For more information contact the Department at 775-684-2000. Click here to view the current tax district map. Each states tax code is a multifaceted system with many moving parts and Nevada is no exception.

Nevadas tax system ranks 7th overall on our 2022 State Business Tax Climate Index. Tax District 200. Prior to the budget hearings the County will publish a newspaper ad which identifies any property tax rate increases as well as.

Clark County collects on average 072 of a propertys assessed fair market value as property tax. District 902 - MESQUITE CITY REDEVELOPMENT. Property tax bills are mailed sometime in July of each year for both Real and Personal Property.

CLARK COUNTY PROPERTY TAX RATES Fiscal Year 2020-2021. Nevada has a 685 percent state sales tax rate a max local sales tax rate of 153 percent and an average combined state and local sales tax rate of 823 percent. Nevadas tax system ranks 7th overall on our 2022 State Business Tax Climate Index.

You may find this information in Property Tax Rates for Nevada Local Governments commonly called the Redbook. Below you will find an example of how to calculate the tax on a new home that does not qualify for the tax abatement. Home Government Elected Officials County Treasurer Tax Rates.

Counties in Nevada collect an average of 084 of a propertys assesed fair market value as property tax per year. Assessment Ratio 35. Then comes a matching of these real properties respective tax assessment amounts within each group.

STATE OF NEVADA. The states average effective property tax rate is just 053. But Nevada does have a relatively high sales tax a state rate is around 7 but goes to approximately 8 when you consider local tax rates.

Total Taxable value of a new home 200000. Clark County Nevada Property Tax Go To Different County 184100 Avg. Frequently a resulting tax bill discrepancy thats 10 or more above the samplings median level will be reviewed.

Nevada is ranked number twenty four out of the fifty states in order of the average amount of property taxes collected. If the time of death is on or after January 1 2005 Nevada does not require filing of Estate Tax and will not require filing until which time the Internal Revenue Service reenacts the Death Tax Credit Nevada that was collected prior to January 1 2005. The property tax rates are proposed in April of each year based on the budgets prepared by the various local governments.

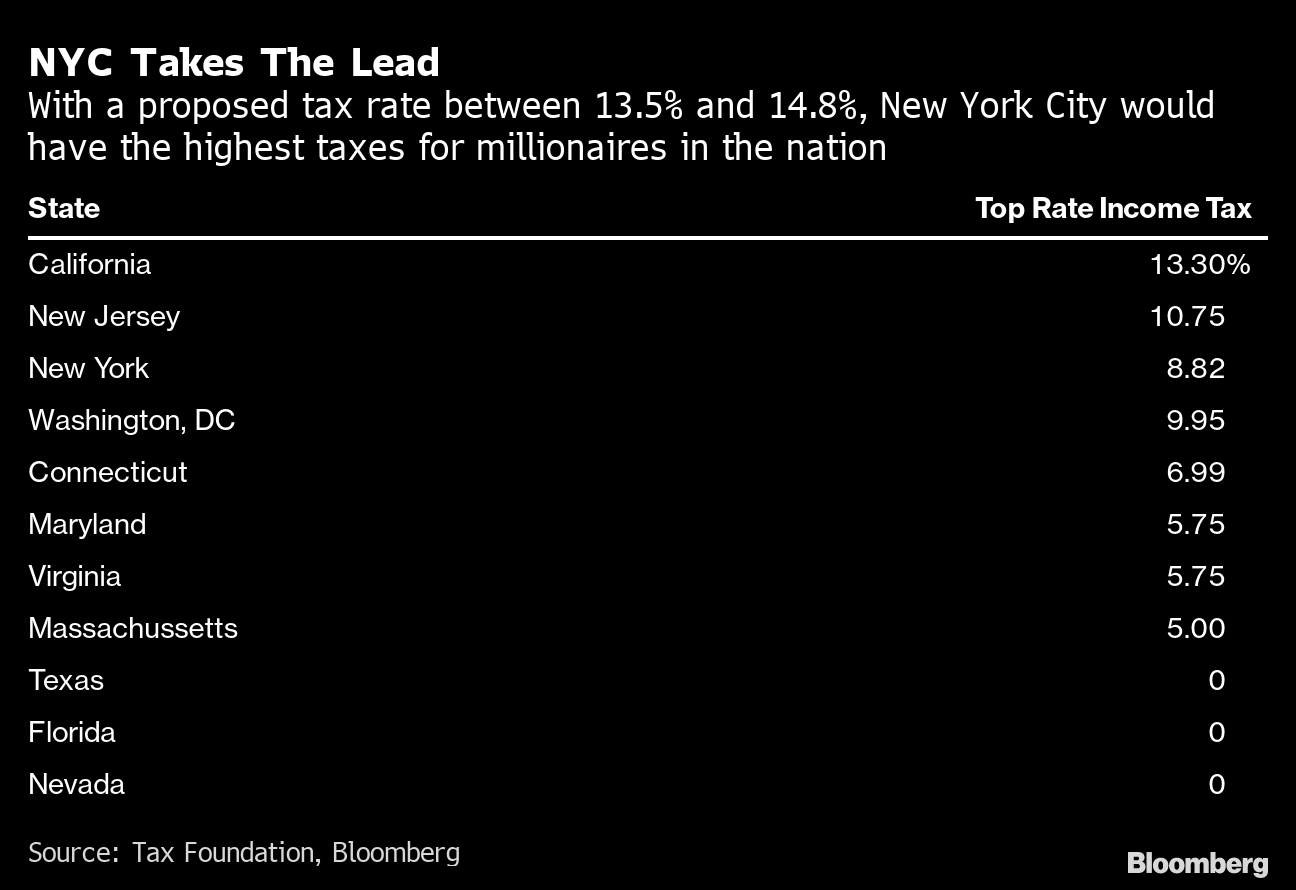

Hedge Funds Are Ready To Get Out Of New York And Move To Florida Bloomberg

2022 Federal State Payroll Tax Rates For Employers

Nevada Paycheck Calculator Smartasset

/How-Is-the-Gift-Tax-Calculated-3505674-v2-HL-cf2d3bd9ac04413ba108e6b0a44f0f39.png)

Gift Tax How Much Is It And Who Pays It

Sales Tax Holidays Politically Expedient But Poor Tax Policy

2022 Capital Gains Tax Rates By State Smartasset

Sales Tax Holidays Politically Expedient But Poor Tax Policy

2022 Capital Gains Tax Rates By State Smartasset

Property Management Locations In Nevada Mynd Property Management

Do I Have To Pay Nevada State Business Income Tax

Should You Move To A State With No Income Tax Forbes Advisor

Bracket Creep Definition Taxedu Tax Foundation

Oregon Tax Rates Rankings Oregon State Taxes Tax Foundation

Oregon Tax Rates Rankings Oregon State Taxes Tax Foundation

Guide To Paying Nanny Taxes In 2022

2022 Capital Gains Tax Rates By State Smartasset

Are There Any States With No Property Tax In 2022

Top 10 Best States For Disabled Veterans To Live 100 Hill Ponton P A

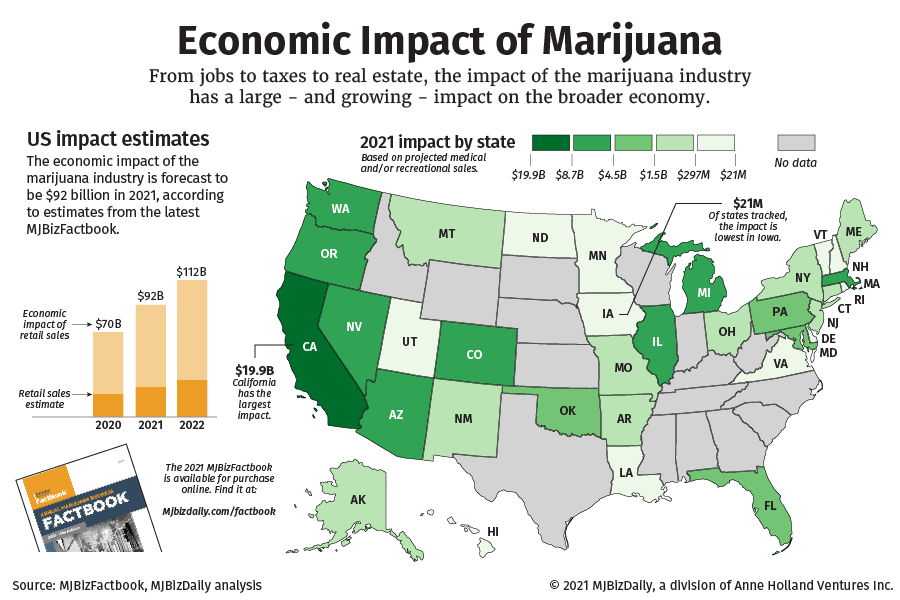

Marijuana Industry Expected To Add 92 Billion To Us Economy In 2021